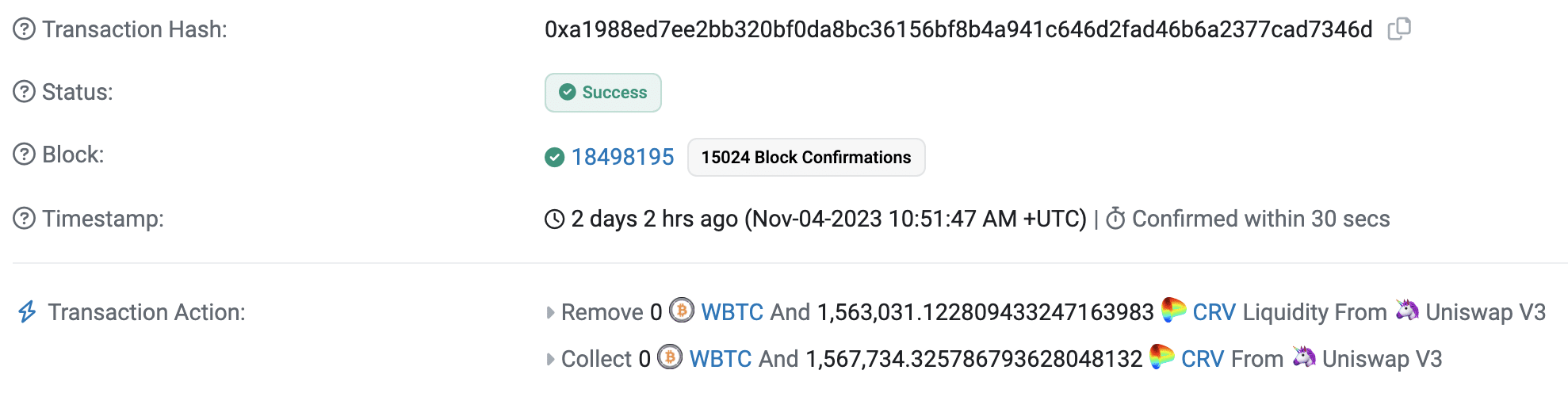

One conceivable clarification that has arisen is that the client confused the CRV token with USD while adding $1.56 million worth of WBTC to the pool. The client consequently got 1.56 million CRV tokens, which in US dollar terms has an ongoing worth of just around $900,000.

What are MEV bots?

Up to this point somewhat obscure, Maximal Extractable Worth (MEV) bots have now turned into a significant piece of the DeFi environment on the Ethereum organization.

The bots are intended to rapidly distinguish and take advantage of benefit open doors on decentralized trades, yet they have additionally been related with a few's idea of tricks and morally sketchy practices.

At times likewise alluded to as Excavator Extractable Worth, the bots benefit by getting diggers (or organization validators) to reorder or control explicit exchanges inside blocks on the blockchain.