Key Points:

- Bitcoin’s recent rally is attributed to dovish FOMC and lower Treasury supply estimates, boosting risk assets.

- Derivative markets signal anticipation of a Bitcoin price surge with elevated perp funding and implied volatility.

- Spot Bitcoin ETF approval could be the catalyst for substantial price gains.

In a recent rally, the focus shifted away from spot Bitcoin ETF developments to macroeconomic factors. The rally was triggered by a smaller-than-expected Treasury Q1 supply estimate and a dovish stance from the Federal Open Market Committee (FOMC). These developments caused bond yields to plummet while risk assets surged.

According to QCP Capital, while this rally may signal the beginning of a new global equity and bond uptrend, the overall macroeconomic landscape remains relatively unchanged, with the correction of overly bearish bond sentiment being the primary shift.

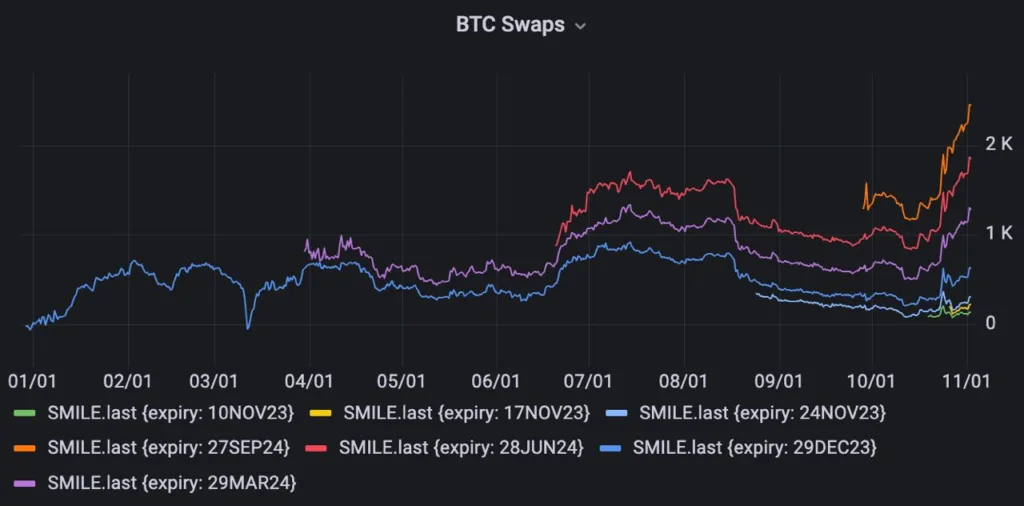

Meanwhile, Bitcoin’s spot price has been steadily rising, accompanied by increased perp funding and term forwards, as well as elevated levels of implied volatility and risk reversals across the curve. For those anticipating an upside breakout in derivatives, the approval of a spot Bitcoin ETF is eagerly awaited.

The coming days hold significant events, including earnings reports from Coinbase and Apple, with the Non-Farm Payrolls (NFP) report scheduled for today. These events could potentially contribute to the realization of implied volatility and particularly high call premiums.

Ultimately, the key catalyst for a new exponential surge is expected to be the approval of a spot Bitcoin ETF. However, it would likely take a significant intervention from SEC Chairman Gensler to push Bitcoin’s price back below the 32,000 USD mark at this stage.

Source: coincu.com

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.